While the U.S. remains the largest listed real estate market, the listed real estate market is increasingly becoming global. The growth is being driven by the appeal of the U.S. REIT approach to real estate investment. Today more than forty countries and regions have REITs, including all G7 countries.

How Many REITs Are There in the World?

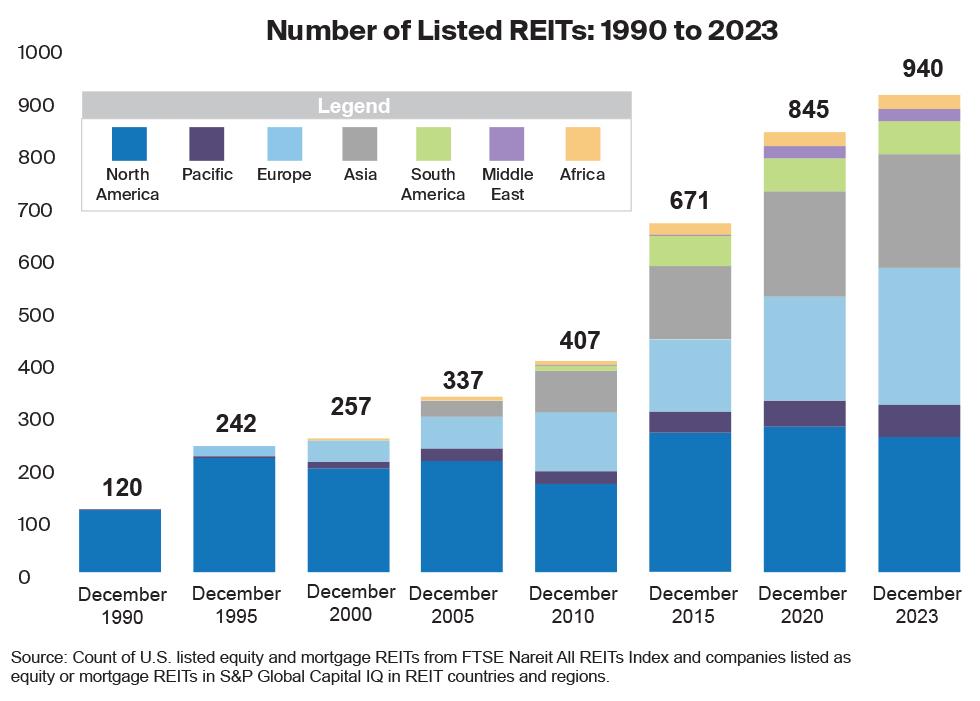

A total of 940 listed REITs with a combined equity market capitalization of approximately $2.0 trillion (as of December 2023) are in operation around the world. As the following charts show, REITs have grown dramatically in both number and equity market capitalization over the past 30 years going from 120 listed REITs in two countries to 940 listed REITs in more than 40 countries and regions.

Europe and the Pacific have seen the largest growth in REITs since 2020, with Europe adding 62 REITs (31% growth) and the Pacific adding 13 REITs (25% growth).

Asia has also seen strong growth at 22% since 2020. China officially established REITs in 2021 and had 29 listed REITs in 2023. In addition, India has more than doubled its number of REITs from two in 2020 to five in 2023.

How Much of the Global GDP and Population Do Countries and Regions with REITs Represent?

Market capitalization for REITs has increased steadily around the world with the largest growth in North America from $8.7 billion in 1990 to $2.0 trillion in 2023. This growth is a testament to the success and durability of the REIT approach.

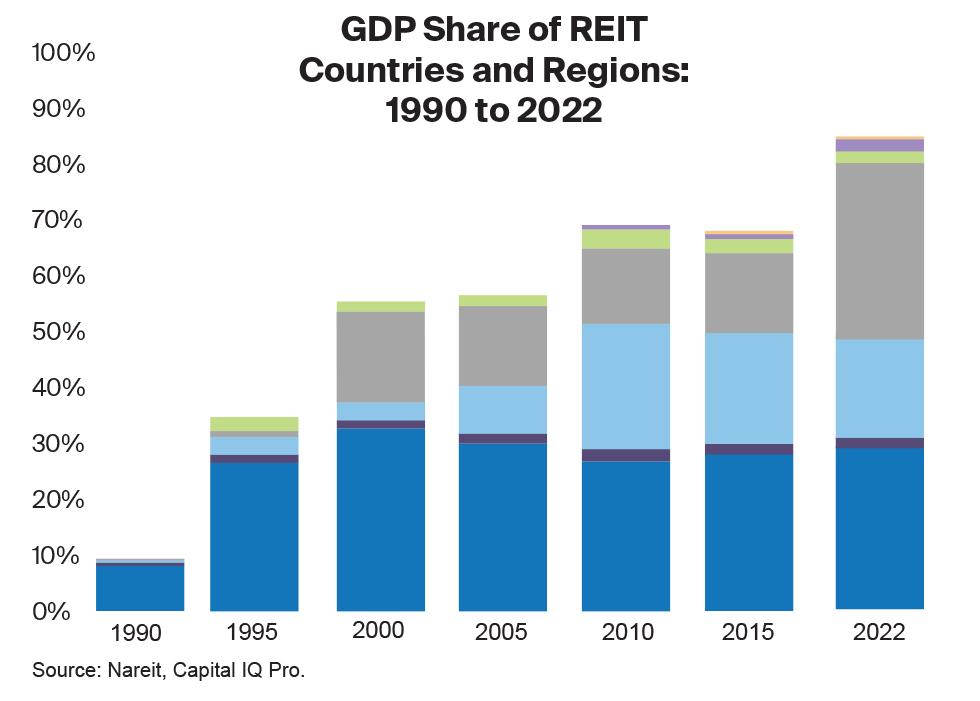

As the REIT model has spread globally, current countries and regions with REITs represent 84% of 2022 global GDP, increasing from 28% of global GDP in 1990. The GDP of REIT countries and regions has increased from $6.5 billion to almost $84 trillion in this time frame.

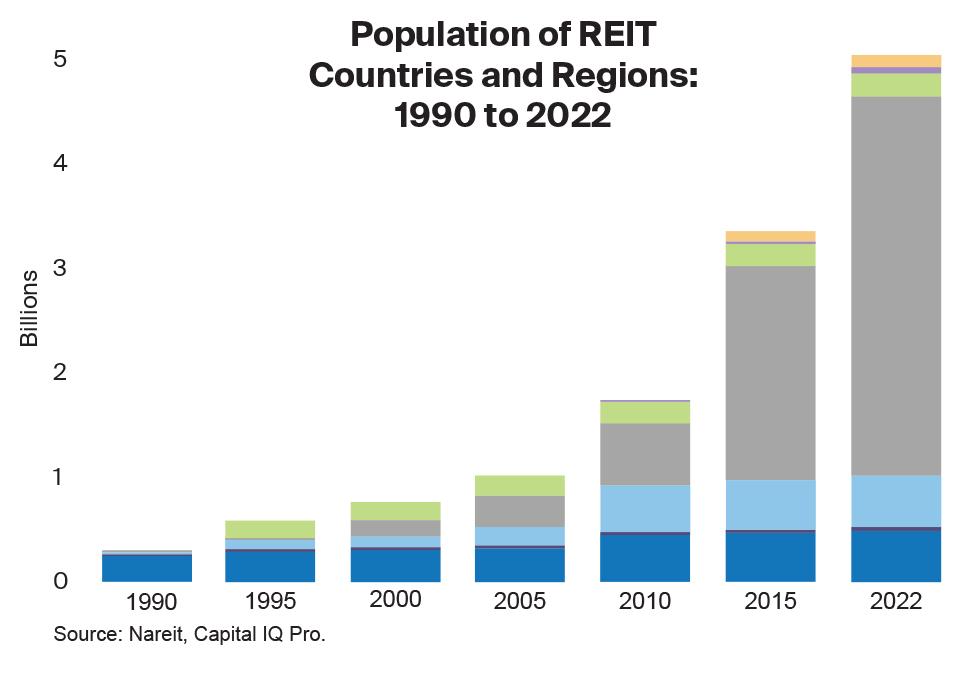

In 1990, REIT countries and regions had just a 6% share of global population, and currently, they account for 63% of the world’s 2022 population. Asia has driven the growth in population for REIT countries and regions, most notably with the adoption of REITs in India in 2014 and China in 2021.

Where Do I Find Information About Establishing a REIT Approach to Real Estate in my Country or Region?

Nareit has produced a Global REIT Approach to Real Estate Investing brochure that addresses the benefits to economies, communities, and investors by adapting a REIT model.

What Benefit Does a Global Listed Real Estate Allocation Provide in a Diversified Investment Portfolio?

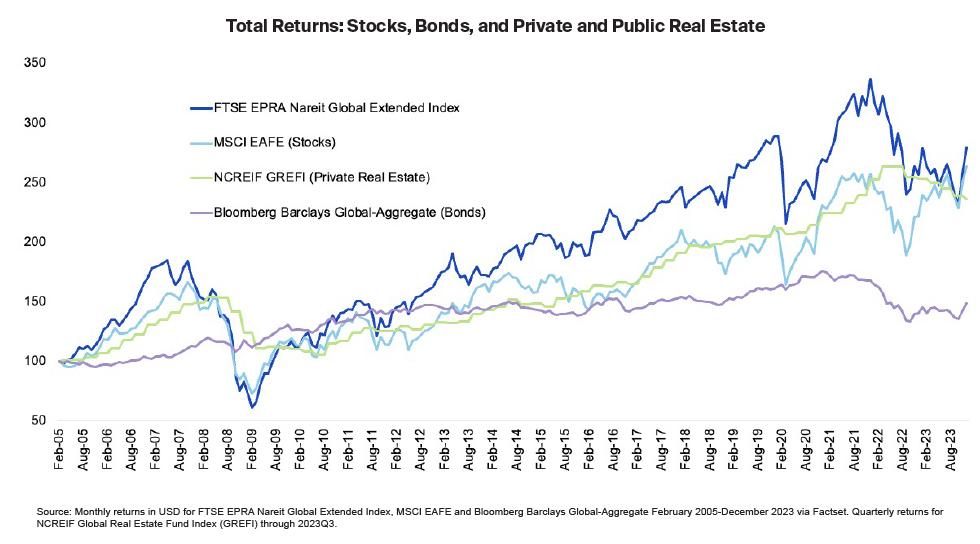

Research done by the investment consulting firm Wilshire Associates showed that an allocation to global listed real estate improved the returns of a diversified investment portfolio.

Wilshire found that REITs play a critical role in improving investment returns and reducing risk in Target Date Funds (TDFs) – popular investment products.

TDFs are designed to simplify portfolio planning for individuals. It is expected that the majority of new 401(k) and IRA assets will be invested in TDFs over the coming decades and the retirement security of millions of Americans will depend upon their investment performance.

Global REIT Approach to Real Estate Investing Brochure

This study summarizes the dramatic growth of REITs around the world since their inception more than 60 years ago and the benefits of the REIT model for communities, economies, and investors. There are currently more than 40 countries and regions, accounting for 84% of global GDP with a combined population of nearly 5 billion people, that have enacted REIT legislation.

How Can I Add a Global Listed Real Estate Allocation to My Portfolio?

The easiest and most cost-efficient way to add a global listed real estate allocation to a portfolio is purchasing an investment in a mutual fund or exchange-traded fund of these securities.

What Are U.S. Withholding Tax Rates on U.S. REIT Ordinary Dividends to Non-U.S. Investors?

The withholding rate on dividends paid by U.S. corporations to non-U.S. shareholders is set by the tax code at 30%. However, The U.S. has entered into bilateral tax treaties with 77 countries to promote cross border investment between the countries by lowering the normal 30% withholding rate. This chart summarizes the withholding tax rates collected on U.S. REIT ordinary dividends paid to non-U.S. shareholders, broken down on a per country basis and based on the type of REIT investor, e.g., individual or corporation.

How Can I Track the Global Listed Property Market?

The most common index for the REIT and global listed property market is the FTSE EPRA Nareit Global Real Estate Index Series, which was created jointly by the index provider FTSE Russell, Nareit and EPRA, the European Public Real Estate Association. The index is used by a variety of institutional investors, money managers and funds to manage real estate investment on a global basis. It contains both REITs and non-REIT listed property companies. The Global Index Series contains the Developed Markets indices and the Emerging Markets indices.

Are There Other Organizations Like Nareit Across the World?

Yes, Nareit is a member of the Real Estate Equity Securitization Alliance: The Global REIT Alliance (REESA). Members of REESA include the Asia Pacific Real Assets Association, (APREA); the Association for Real Estate Securitization (ARES); the British Property Federation (BPF); the European Public Real Estate Association (EPRA); the Property Council of Australia (PCA); the Real Property Association of Canada (REALPAC); and Nareit.